Update Published June 15, 2020

Why Do Federal Tax Deposits Matter?

Businesses with employees are generally required to make IRS Form 941 Withholding deposits throughout the quarter. When businesses are unable to make those required deposits, there are several potential problems. Insufficient deposits can:

- Result in an IRS liability when the return is filed, which exposes the business (and its lender) to levies and federal tax liens,

- Prevent the IRS from entering into an Installment Agreement – a business must make its federal tax deposits in full and on time throughout the current quarter in order to enter into an agreement,

- Jeopardize an existing Installment Agreement – liabilities outside the agreement can default and terminate that agreement, and

- Jeopardize a business’s funding relationship – lenders generally stop funding to avoid exposure to the IRS.

The most important part of resolving a business’s federal tax liability is stopping the bleeding – making sure all federal tax deposits are made in full and on time. The good news is that once a business stops the bleeding, the issues identified above can be addressed and overcome.

Employment Taxes

There are three components to employment taxes.

- The amount withheld from the employees’ paychecks,

- The employee portion of FICA taxes (Social Security and Medicare), and

- The employer-matching portion of FICA taxes (Social Security and Medicare).

Employment taxes are calculated and reported to the IRS on the 941 Withholding series of returns.

Withholding Returns (941 series)

The most common withholding return, by far, is the 941 withholding. Federal law requires employers to withhold certain taxes from their employees’ pay, i.e., employment taxes. The wages subject to federal income tax withholding, Social Security, and Medicare taxes are reported quarterly on the 941 return. The 941 return must be filed on the last day of the month following the end of the quarter, e.g., the first quarter 941 return is due April 30.

Special rules apply to some employers…

- Form 943 captures wages paid for agricultural labor. The 943 return is filed annually and must be filed by January 31 of the following year.

- Form 944 is designed so the smallest employers (those whose annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less) will file and pay these taxes only once a year instead of every quarter. The annual return must be filed by January 31 of the following year.

- Form 945 is used to report withheld federal income tax from non-payroll payments, including pensions, annuities, IRA distributions, military retirement, gambling winnings, Indian gaming profits, certain government payments, dividends and other distributions by an Alaska Native Corporation (ANC), and payments subject to backup withholding. The annual return must be filed by January 31 of the following year.

Making FTDs (EFTPS)

Businesses making FTDs must use EFTPS (Electronic Federal Tax Payment System), which can be found at EFTPS.gov. If a business attempts to make a federal tax deposit using any other method, the payments will not be considered timely and may not be processed as “deposits.”

Practice Pointer. A deposit must be initiated through EFTPS no later than 8:00 p.m Eastern the day before it is due. If a business attempts to initiate a deposit on the day it is due, the deposit will not be processed until the following date, which exposes the businesses to a failure to deposit penalty.

Generally, failure to deposit through EFTPS or to allow 24-hours to process the deposit may result in the assessment of unnecessary penalties.

In theory, businesses can still make a timely “same day” deposit via wire through the Federal Tax Collection Service (FTCS). To use the same-day wire payment method, a business would need to make arrangements with its financial institution ahead of time, which decreases the effectiveness of the program (if a business sets up a wire the day before the deposit is due, it could just as easily do so through EFTPS). Additionally, it is difficult to initiate, properly allocate, track, and confirm payments to the IRS made via wire transfer.

When are Federal Tax Deposits Due?

Making federal tax deposits in full and on time is essential to avoid costly penalties. The due date for Federal Tax Deposits (FTDs) is based on two factors:

- Whether the business is a monthly or semi-weekly depositor, and

- When paychecks are distributed (payday).

A business’s deposit schedule is not determined by how often it pays its employees. Instead, the IRS uses two different sets of deposit rules to determine when businesses must deposit Social Security, Medicare, and withheld federal income taxes. These schedules instruct a business when a deposit is due after payday – either monthly or semi-weekly.

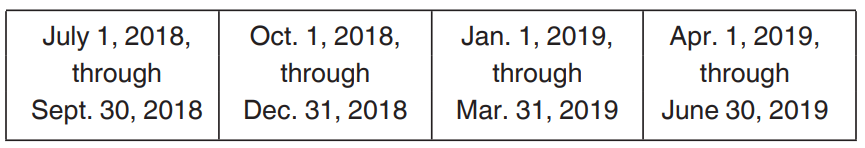

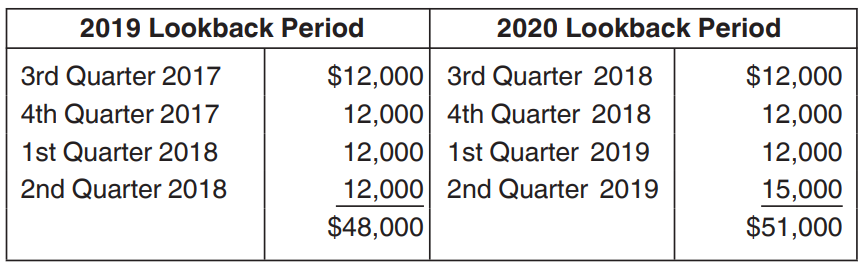

Lookback Period. The lookback period is used to determine whether a business must make deposits on a monthly or semi-weekly basis. For Form 941, the lookback period is the twelve months ending on June 30 of the prior year (e.g., 2020’s lookback period consists of the third and fourth quarters of 2018, and the first and second quarters of 2019). For Form 944, it is the calendar year two years prior (e.g., 2020’s lookback period is 2018).

Lookback Period for 2020 (941 Taxes)

Example. To determine the deposit schedule for 2020, a business would total its deposits from July 1, 2018 to June 30, 2019.

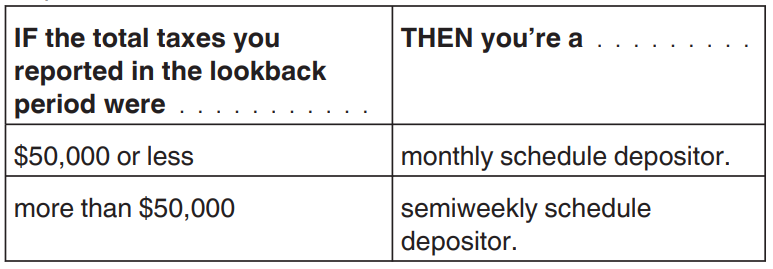

The total deposits during the 2019 lookback period ($48,000) is less than $50,000. As such, the business would be considered a monthly depositor for all of 2019. However, the business would change to a semi-weekly depositor in 2020. The total deposits during the 2020 lookback period ($51,000) is more than $50,000.

Monthly Deposits. Businesses with less than $50,000 deposited during the lookback period must make the corresponding FTD no later than the 15th of the following month. For example, for all wages paid in July, the corresponding deposit is due August 15.

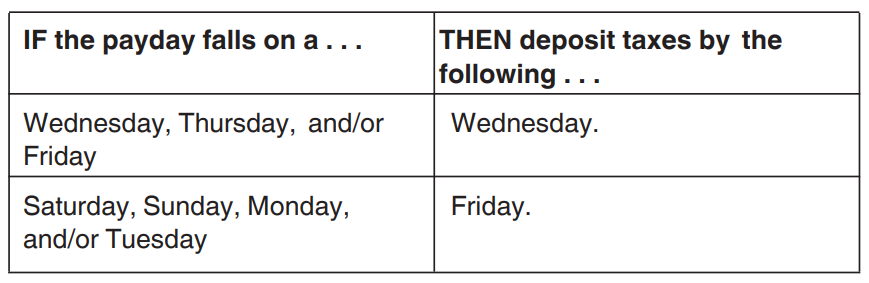

Semi-Weekly Deposits. Businesses with deposits of $50,000 or more during the lookback period must make the corresponding FTD on either the Wednesday or Friday following the payday.

- For wages paid on Saturday, Monday, or Tuesday, the corresponding deposit must be made the following Friday.

- For wages paid on Wednesday, Thursday, or Friday, the corresponding deposit must be made the following Wednesday.

Next-Day Deposits. In limited circumstances, the deposit is due the day after payday. If a business has more than $100,000 in tax liabilities in the period of time between tax deposits during which employment tax liabilities accrue, the corresponding deposit must be made the business day after payday.

When federal tax issues arise, don’t wait for the IRS to file a tax lien or issue levies. Be proactive. Fill out the form below to speak with a specialist.